LOQBOX: Empowering Financial Transformation through Credit Building

In a world where credit scores wield significant influence over financial opportunities, LOQBOX has emerged as a beacon of hope for those seeking to enhance their creditworthiness.

In a world where a credit score significantly influences financial opportunities, Loqbox has emerged as a ray of sunshine for those seeking to enhance their creditworthiness.

Considering the critical importance of a healthy credit profile, Loqbox has developed an innovative solution that empowers individuals to take control of their financial future.

This extended review will explore Loqbox’s key features, benefits, pricing, and overall user satisfaction.

About Loqbox

Loqbox is a unique credit-building platform launched by Tom Eyre and Gregor Mowat, designed to assist individuals in boosting their credit scores through structured savings.

Unlike traditional credit-building methods that often involve high-interest loans or secured credit cards, Loqbox offers a refreshingly different approach. It enables users to improve their credit scores while saving money simultaneously.

The platform’s mission is to empower individuals with limited or damaged credit histories to unlock better financial opportunities.

Loqbox Save – How does it work?

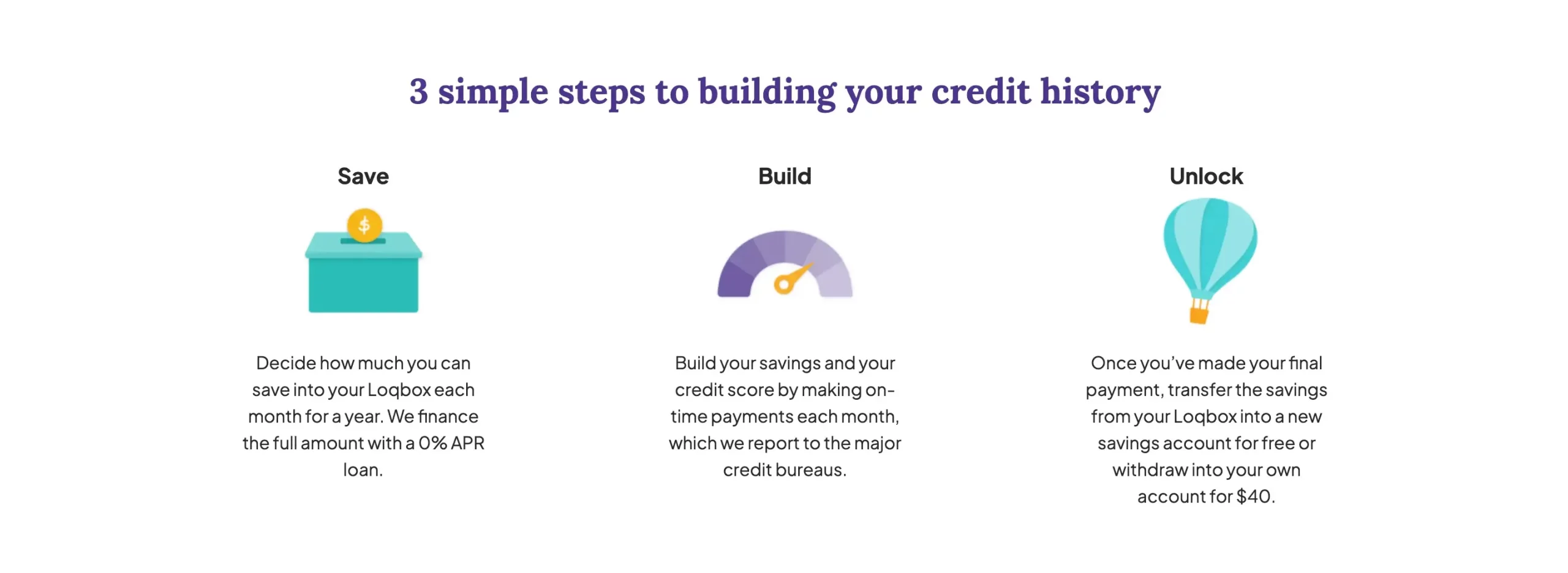

The mechanism behind Loqbox Save is elegant in its simplicity. Users create a Loqbox account and choose the desired monthly savings amount, ranging from as low as £20 to £200 or more.

Rather than depositing this sum directly into a traditional bank account, the platform transforms it into a virtual installment loan. For 12 months, users consistently make these payments by monthly direct debit or by debit card while building a credit history. If you choose to pay by direct credit, pay attention to the payment date you set, as it cannot be changed afterward.

At the end of the cycle, Loqbox converts the sum into a cash savings account, thereby enabling users to reap the benefits of both credit improvement and savings. Users can withdraw the Loqbox savings in a new savings account or transfer it to an existing bank account for the price of ̀£40.

Over this time, the platform reports your activity to three credit bureaus so that they can increase your credit rating. Loqbox reports your payments to Experian, TransUnion, and Equifax.

Loqbox – Features

Credit building – The primary feature of the platform is its credit-building capability. By effectively demonstrating responsible financial behavior through monthly payments, users can establish or enhance their credit history and score;

Structured savings – Loqbox incorporates a forced savings element into the credit-building process. This ensures that users not only improve their credit profiles but also accumulate savings over the 12-month period;

Personalized plans – Loqbox tailors its offerings to individual users, allowing them to select a monthly savings amount that aligns with their financial capabilities and goals. Furthermore, you can withdraw your savings into your own account or into an existing account;

Educational resources – Loqbox provides users with educational materials and resources to enhance their financial literacy. This empowers users to make informed decisions and take control of their financial well-being;

Other Tools

Loqbox Grow

Loqbox Grow is an interest-free credit account shaped to boost users’ credit scores by using the platform and tool for their membership payments. Basically, once you have gained some funds in your account, you can use them to pay for the membership for the platform.

Users simply have to open a new account on Loqbox. This process can take up to 2 minutes. There is no credit card check, and no hidden charges will be applied. Then, the account is reported to the 3 credit reference agencies, and using it responsibly helps the user improve their credit score over time. The platform claims that the improvement can reach approximately 125 points in the first 6 months.

Loqbox Rent

You can also build your credit by simply paying the rent. It doesn’t actually matter if you have to pay it to a letting agent, the local council, your parents, or a private landlord.

All you have to do is connect an account from a partner bank, enter the rent date and amount, and Loqbox will do the rest. The regular rent payments are reported to the credit reference agency Experian.

Loqbox – Pricing

Loqbox offers a range of pricing options to cater to different financial situations. Users can choose monthly savings amounts that align with their budgets.

The minimum monthly contribution is as low as £20, while higher amounts are available for those who wish to accelerate their credit-building journey. You also have to pay a monthly membership of around £2.5. It’s important to note that Loqbox does not charge interest, making it a transparent and affordable credit-building solution.

Loqbox – Pros and Cons

Loqbox Pros

- Innovative approach – Loqbox’s blend of credit building and structured savings offers a fresh and effective way to address financial needs;

- Accessible to all – Loqbox is suitable for individuals with various income levels and credit backgrounds, as it doesn’t require a credit check to join;

- No interest – The absence of interest ensures that users can focus solely on building credit and savings;

- Financial education – Loqbox provides educational resources to empower users with financial knowledge, promoting long-term financial health;

- Improvement in credit scores – User experiences and reviews indicate that Loqbox can indeed lead to noticeable improvements in credit scores.

Loqbox Cons

- 12-month commitment – While the 12-month period is relatively short, some users might prefer a faster credit-building solution;

- Savings dependency – While the structured savings component is beneficial, users may find it restrictive if they need access to the funds during the commitment period.

Loqbox – Overall Score

To gauge the overall user sentiment, we turn to various platforms where users share their experiences and reviews.

As of the last available data, Loqbox has built a positive reputation, with a majority of users expressing satisfaction with the platform’s approach and results. Many reviewers have highlighted the platform’s effectiveness in improving credit scores and commended its user-friendly interface.

It’s important to note that individual experiences can vary based on factors such as financial goals, credit history, and commitment to the program. However, the overall positive sentiment underscores the potential of Loqbox to make a meaningful impact on users’ financial lives.

In Conclusion

Loqbox’s innovative approach to credit building and savings is a significant step towards addressing a common financial challenge. By providing users with the tools to enhance their credit scores while simultaneously accumulating savings, Loqbox empowers individuals to unlock better financial opportunities.

Its transparent pricing, educational resources, and user-friendly interface make it an attractive option for those seeking to improve their financial health. While Loqbox’s 12-month commitment and structured savings approach might not be suitable for everyone, its positive user reviews and track record of credit score improvement indicate its potential effectiveness.

For individuals looking to embark on a journey of credit enhancement and financial empowerment, Loqbox presents a compelling solution that aligns with modern financial needs.